When we pay for electricity, the charge is based on the number of kilowatt hours we use. For natural gas, we pay for the number of cubic feet we use. For cell-phone service, it’s typically the number of minutes we use.

If we think of transportation as another utility service, does it make sense to consider basing the charge in the same way — according to how much we actually use?

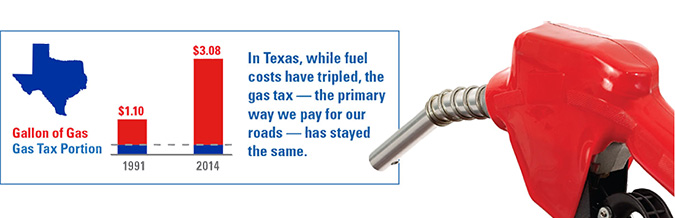

That’s the question on the minds of officials in some states determining how best to fund their transportation needs. Many see a need for a revenue source more sustainable than the motor fuels tax, the value of which has eroded over time due to inflation and increased fuel efficiency.

It’s also the focus of one of the first studies undertaken by the Texas A&M Transportation Institute’s (TTI‘s) new Transportation Policy Research Center (TPRC). Assistant Research Scientist Trey Baker examined Oregon’s experiment with road-user charges (RUCs) and the concept’s potential applicability in Texas.

In a 2002 pilot test, the Oregon Department of Transportation (ODOT) first tested the RUC concept with about 285 vehicles outfitted with a specially designed road-use measurement system. The system allowed vehicle owners to pay their travel fees where they’d routinely pay their fuel tax: at the gas pump. In examining an array of RUC factors — privacy being high on the list — officials determined the concept was viable.

“The actual implementation of these fee systems is likely to be a lot less scary than what the public expects,” Baker says. “If a driver has concerns about ‘government tracking,’ then they will likely have the option of not using a device at all or using one of many private-sector technology and account management service providers.”

A second ODOT pilot test involved an RUC in lieu of fuel-tax payments. Participants were offered a range of options on several aspects of the program, including how the fees would be assessed and who would manage participants’ accounts — ODOT or a private-sector provider. Depending on the option chosen, participants could ensure that they were charged for all miles driven (basic), only for travel on state-maintained roadways (advanced), or for estimated annual mileage (flat fee). Participants could also choose to use a smartphone app, which allowed switching between the advanced and basic options.

Officials reported no major problems with the second pilot, and participants gave high marks for the availability of multiple service plans.

After considering input from stakeholders and the public, Oregon lawmakers passed legislation in July 2013 authorizing up to 5,000 vehicle owners to pay a 1.5-cent-per-mile RUC in place of the state’s motor fuels tax. The new law represents a step toward possible statewide implementation.

Regardless of whether Texas pursues a similar path, Baker’s research can provide insight to any related discussions.

“It’s important that more states are exploring alternatives for transportation funding, along with the related policy considerations,” says TPRC Director Ginger Goodin. “And our study is a prime example of how research can inform those policy considerations.”